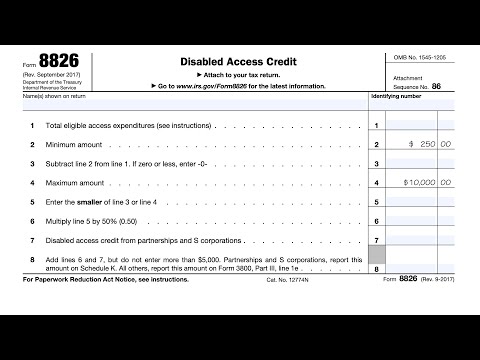

This video we'll be going over IRS form 8826 disabled Access Credit this is a tax credit that's generally available to small businesses to provide or to spend money on providing access improvements for certain people under uh in compliance with the Americas with Disabilities Act so this is a this can be a wide-ranging uh set of expenditures anything from providing interpretive services for deaf and hard of hearing people to providing visual uh access for visually impaired people providing any kind of structural access improvements to your workspace or to your place of you know retail uh so there's a lot that you can include under this umbrella but there are a couple of key things to remember now I'll take a pause here and point out that this uh this form is fairly straightforward there's only eight lines we will go through them uh the the devil and the details really is on the back where we have to kind of closely Define what an eligible small business is what eligible access expenditures are and what a disability is so we'll go through that for a few minutes and then we'll Circle back and walk through this form step by step so for purposes of taking this tax credit an eligible small business is any business or a person that had gross receipts for the preceding tax year that did not exceed one million dollars or the business had no more than 30 full-time employees during the preceding tax year and that business elects by filing this form 8826 to claim the disabled Access Credit for the tax year so to further clarify the definition gross receipts are reduced by returns and allowances made during the tax year employees are considered to be full-time if they're employed...

PDF editing your way

Complete or edit your 8926 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export irs 8926 form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 8926 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your irs form 8926 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Form 8926

- Form 8926 was last revised in December 2017

- Form 8926 is used to report interest paid or accrued by a corporation for the tax year

- The form includes details about related persons receiving disqualified interest

Award-winning PDF software

How to prepare Form 8926

About Form 8926

Form 8926 is a document used by taxpayers to report any discrepancies in the amounts reported on Form 1098-T, which is the educational institution's statement of tuition and related expenses, for qualified tuition and related expenses. The purpose of this form is to reconcile the amounts claimed for education tax credits, such as the American Opportunity Credit or Lifetime Learning Credit, with the amounts reported by the educational institution. Individuals who have claimed education tax credits and find that the amounts reported on their Form 1098-T differ from what they have claimed will need to file Form 8926. This form allows taxpayers to explain the discrepancies and provide supporting documentation to substantiate the claimed amounts. It is essential to ensure accurate reporting to avoid any potential tax penalties or audits related to education tax credits.

How to complete a Form 8926

- Begin by entering the name of the corporation and the name of the parent if it is part of an affiliated group

- Check the box if filing on behalf of an affiliated group

- Fill in the total amount of the corporation's money at the end of the tax year and the adjusted basis of all other assets

- Calculate the sum of lines 1a and 1b, then subtract line 1d from that total

- Calculate the debt to equity ratio by dividing line 1d by line 1e

- Enter information about any stock holdings related to disqualified interest, if applicable

People also ask about Form 8926

What people say about us

How you can fill in forms without having mistakes

Video instructions and help with filling out and completing Form 8926