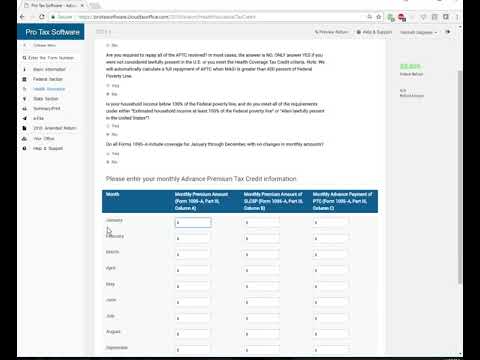

Next up, we're gonna cover everybody's absolute most favorite topic, drumroll... healthcare! Joking, everybody hates it. Entering that information in takes forever. To get the 1095-a is your taxpayer, I have no idea, they lose it, it delays everything. So we've made it very simple to enter in. We can't do anything about the delays and the taxpayer losing their junk, but anyway, putting it in the system is real simple. We've got this stethoscope icon here and the words health insurance. So, make it real simple, click on that guy, and then we start the questionnaire. First thing, did you have health insurance at any time? We'll bounce back and forth between the two here. Could continue, yes we did. And did you purchase the health insurance through the marketplace? If we say no, we're just gonna declare it. Is this our household, this everybody that was on our policy? Sure was, sure was. And did you have it for all 12 months? In that scenario, life is beautiful, everybody loves you, the birds are singing outside, sun shining on your face, just the right amount, your perfect temperature. But that is very rarely the case. So, did you or your family have health insurance? Sure did, great thanks! Did you purchase it through the marketplace? Yes we did, click continue. Great! Is this everybody in the insurance? Yep. Did you have it for all 12 months for everybody? No, great. So, who didn't have it all year long? Well, primary went unemployed for four months at the beginning of this year. January, February, March, April. Those are the months that they were unemployed. It wasn't affordable. So, did you receive a 1095-a? Yes, I did. Are you required to pay it all back? Nope, is your nope. And...

Award-winning PDF software

8926 instruction 2025 Form: What You Should Know

Form IRS 8926 Fill Ombudsperson Form 8926 Fill and fax, Post-Packet, Printable (No Form 8865 on paper) This is a “Form 8926 for the purposes of IRS Publication 1368 (IRS Publication 590) and IRS Publication 590A and also applies to certain corporations for the purpose of applying the exclusion for the corporate form of the qualified interest payment made or accrued by a taxpayer in excess of 100,000 (200,000 if filing under a business structure). You are not required to use the Form 8865-A as an electronic filing option if you are completing Form 8926 electronically instead of using the electronic form. If you do not use this form, you do not have to complete a Form 8865. See: Form 8926 (Rev. 3/18/15)(for information regarding the Form 8865-A) ▷ Go to for instructions and the latest information. OMB No. . Paying or accruing disqualified interest in this year, and accruing or having paid or accrued disqualified interest in any future year must be reported using the electronic form. If you are not filing electronically, please submit a paper Form 8865 before completing and submitting online. OMB No. . If you choose to use the electronic filing option, make sure to complete your tax return using the electronic form. Make sure to complete the Form 8865 and the Form 8926 if they are required on your Form 8865. Form 8926 (Rev. December 2017) — IRS The information on Form 8926 (Rev. December 2017) — IRS should be used for the following purposes: ▷ Make sure that you do not submit incorrect information for Form 8926 (Rev. December 2017) — IRS. OMB No. 1606.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8926, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8926 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8926 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8926 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8926 instruction 2025